How to Determine Which Annuitiy Equation to Use

Ad Fixed Annuity Can Provide a Very Secure Tax-Deferred Investment. In all annuity formulas the following symbols are used.

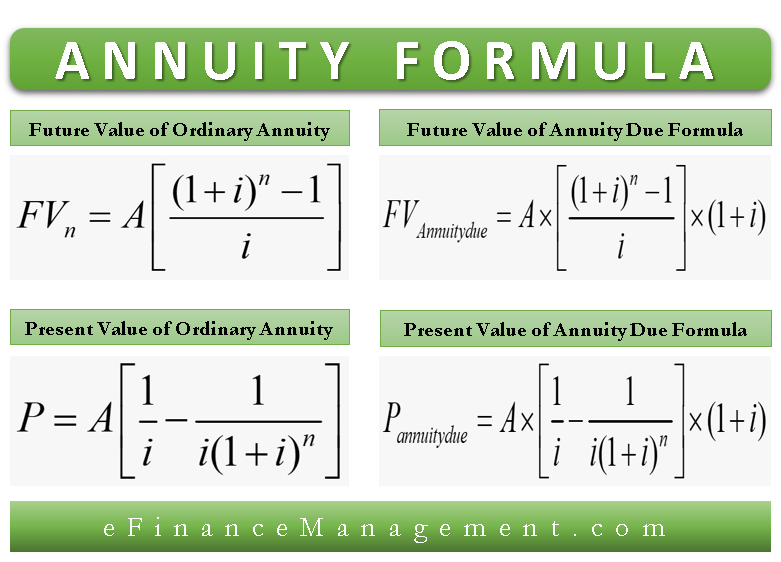

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Calculate the amount of the payments based on your specific situation.

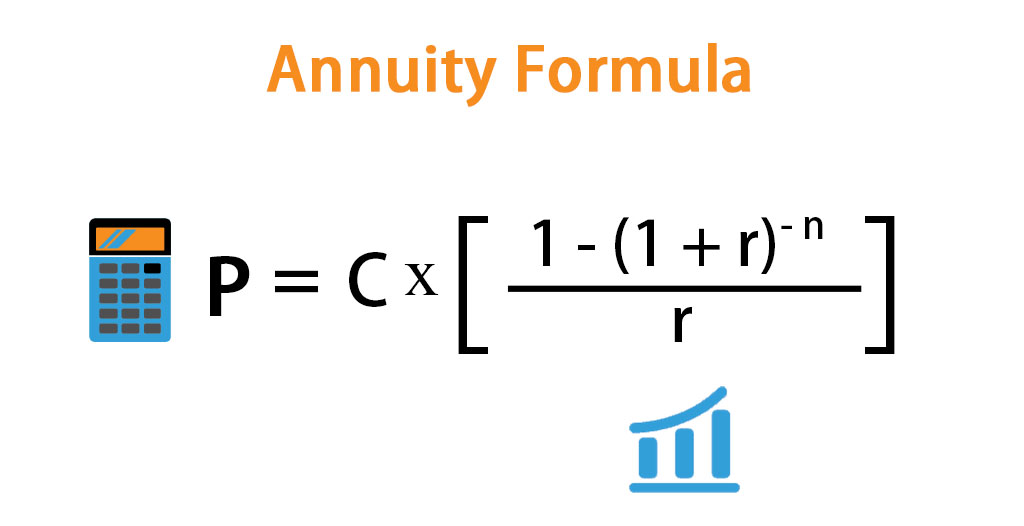

. If we want to see what is the lump sum amount which we have to pay today so that we can have stable cash flow in the future we use the below formula. FV Ordinary Annuity C 1 i n 1 i where. FV Future value.

Then solve each problem. PV Present Value. P Value of each payment r Rate of interest per period in decimal n Number of periods.

Following is the annuity formula to show how to calculate annuity. N number of periods. P Present value of your.

Its important to understand exactly how the NPV formula works in Excel and the math behind it. Ad Compare income annuity quotes from across the market quickly and for free. Income Annuity Quotes From Top-Rated Insurers.

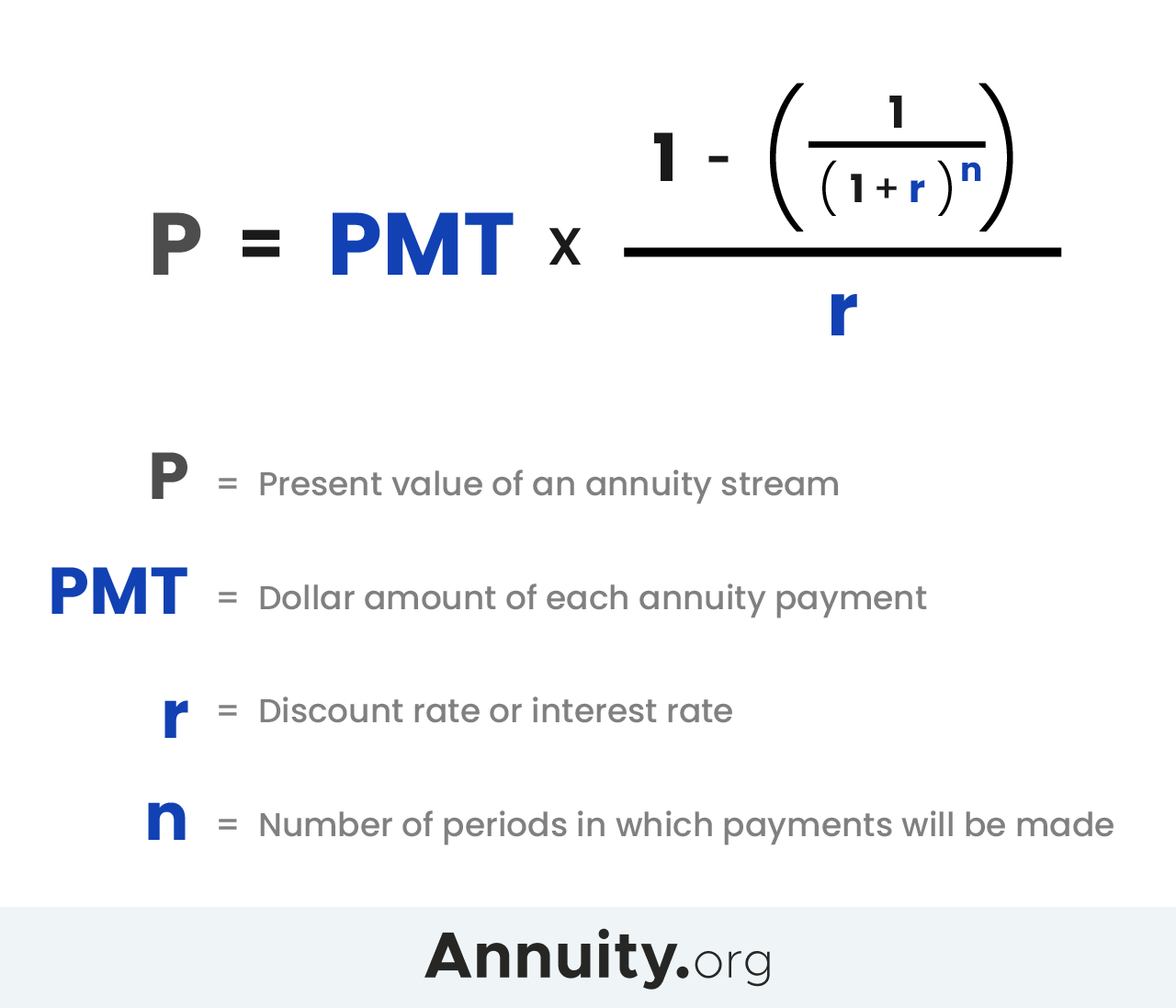

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. Know the correct formula for finding annuity payments. Annuity r PVA Due 1 1 r-n 1 r Where PVA Due Present value of an annuity due.

P r PV 1- 1r-n where. PV Present value. For each of the following scenarios determine if it is a compound interest problem a savings annuity problem a payout annuity problem or a loans problem.

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. The listing below summarizes the various formulas to use for annuity calculations. Annuity 76421512 764215.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. In the formula the. Annuity r PVA Due 1 1 r -n 1 r Annuity 5 10000000 1 1 5 -20 1 5 Calculation of Annuity Payment will be.

Here P annuity due Present value of the annuity due A Annuity cash flow i rate. R Effective interest rate. For example assume a 500000 annuity with a 4 interest rate that will pay a fixed annual.

R Rate Per Period. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. We can calculate the present value of annuity due payments using the following formula.

Guaranteed income starting immediately. A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan. Learn some startling facts.

Use the following formula to calculate your monthly annual and lifetime annuity income. P C 1 1 r-n r. ANNUITY FORMULA latexP_Nfracdleftleft1fracrkrightNk-1rightleftfracrkrightlatex P N is the balance in the account after N years.

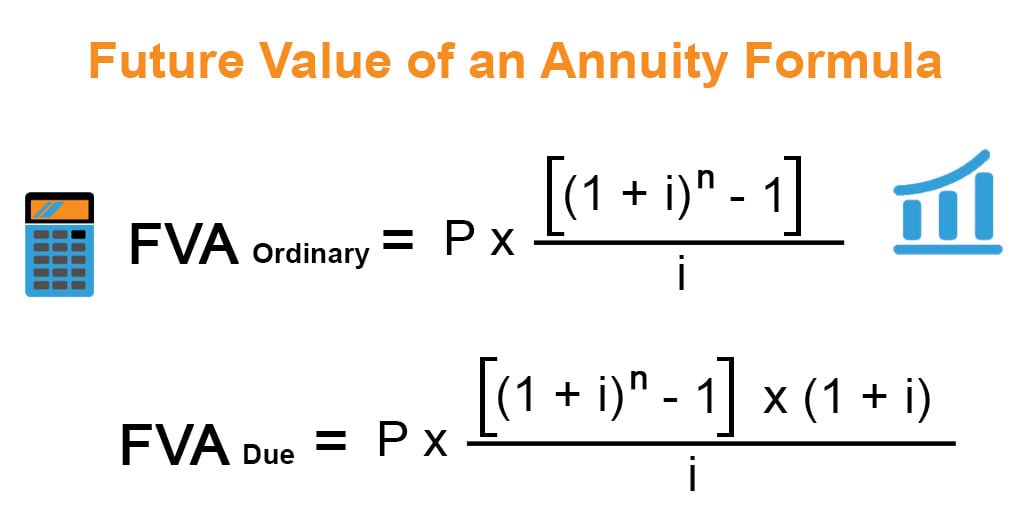

C cash flow per period i interest rate n number of payments beginaligned textFV_textOrdinaryAnnuity. The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where. N Number of Periods.

Ad Annuities are often complex retirement investment products. N Number of periods. What is the Formula to Calculate Annuity in Present Value and Future Value.

NPV F 1 rn where PV Present Value F Future payment cash flow r Discount.

Future Value Of An Annuity Formula Example And Excel Template

Annuity Formula Calculation Examples With Excel Template

No comments for "How to Determine Which Annuitiy Equation to Use"

Post a Comment